All Categories

Featured

Table of Contents

That usually makes them a much more affordable option for life insurance policy protection. Lots of people obtain life insurance coverage to assist economically safeguard their loved ones in case of their unforeseen fatality.

Or you may have the alternative to transform your existing term coverage into a long-term policy that lasts the rest of your life. Different life insurance coverage plans have prospective advantages and downsides, so it's vital to recognize each prior to you determine to buy a policy.

As long as you pay the costs, your recipients will obtain the fatality advantage if you die while covered. That said, it's essential to note that the majority of policies are contestable for 2 years which suggests protection can be rescinded on death, must a misrepresentation be located in the app. Policies that are not contestable usually have actually a graded fatality benefit.

Understanding the Benefits of Term Life Insurance With Accelerated Death Benefit

Costs are normally less than whole life policies. With a degree term plan, you can choose your protection amount and the policy size. You're not locked right into an agreement for the rest of your life. Throughout your plan, you never need to worry about the premium or fatality advantage amounts transforming.

And you can't pay out your policy throughout its term, so you will not obtain any economic take advantage of your previous coverage. Similar to other sorts of life insurance policy, the cost of a level term policy depends on your age, protection needs, work, lifestyle and wellness. Typically, you'll locate extra affordable protection if you're younger, healthier and less risky to insure.

Since level term premiums stay the very same for the period of coverage, you'll recognize exactly just how much you'll pay each time. Level term insurance coverage additionally has some adaptability, permitting you to personalize your policy with added functions.

How Do You Define Level Benefit Term Life Insurance?

You may have to meet specific problems and qualifications for your insurance provider to enact this biker. On top of that, there may be a waiting duration of approximately six months prior to working. There additionally might be an age or time limitation on the coverage. You can add a kid rider to your life insurance policy policy so it also covers your youngsters.

The fatality benefit is normally smaller sized, and insurance coverage normally lasts up until your kid transforms 18 or 25. This rider might be a more cost-efficient way to assist guarantee your youngsters are covered as bikers can usually cover multiple dependents at the same time. Once your child ages out of this protection, it may be possible to convert the motorcyclist into a brand-new plan.

The most common kind of permanent life insurance is whole life insurance policy, however it has some vital distinctions compared to degree term insurance coverage. Right here's a standard review of what to take into consideration when contrasting term vs.

What is Term Life Insurance For Couples? The Key Points?

Whole life insurance lasts insurance coverage life, while term coverage lasts for a specific periodDetails The costs for term life insurance are usually lower than entire life insurance coverage.

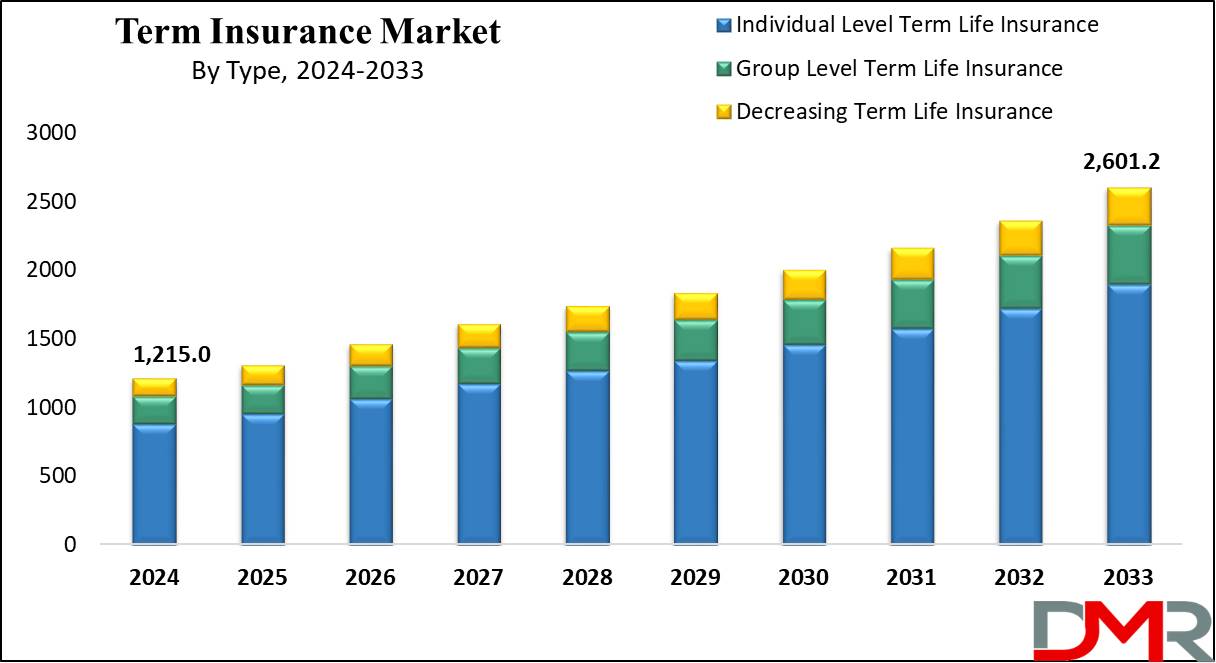

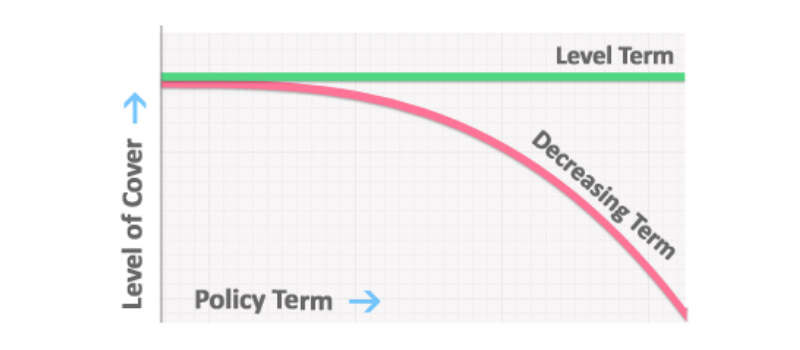

Among the highlights of level term coverage is that your premiums and your fatality advantage do not transform. With reducing term life insurance policy, your costs stay the very same; nonetheless, the death benefit amount gets smaller sized with time. For instance, you might have protection that begins with a survivor benefit of $10,000, which can cover a home mortgage, and afterwards each year, the death benefit will reduce by a collection amount or percentage.

Due to this, it's typically a more budget friendly type of level term insurance coverage., but it might not be sufficient life insurance coverage for your demands.

What is 20-year Level Term Life Insurance and Why Is It Important?

After determining on a policy, finish the application. If you're approved, sign the documents and pay your initial premium.

You might want to upgrade your recipient information if you've had any type of substantial life adjustments, such as a marriage, birth or divorce. Life insurance can often feel complicated.

No, degree term life insurance policy doesn't have money worth. Some life insurance policy policies have an investment attribute that permits you to develop cash money worth gradually. A section of your premium payments is reserved and can gain rate of interest over time, which expands tax-deferred during the life of your coverage.

These plans are usually significantly extra costly than term insurance coverage. If you reach the end of your policy and are still alive, the coverage finishes. Nevertheless, you have some options if you still desire some life insurance policy protection. You can: If you're 65 and your protection has actually gone out, for instance, you might wish to purchase a brand-new 10-year level term life insurance policy plan.

How Does What Does Level Term Life Insurance Mean Compare to Other Types?

You might be able to convert your term insurance coverage into an entire life plan that will certainly last for the remainder of your life. Numerous sorts of level term policies are convertible. That suggests, at the end of your coverage, you can convert some or every one of your policy to whole life insurance coverage.

A degree costs term life insurance policy strategy allows you stick to your budget while you help shield your family. Unlike some tipped rate strategies that raises yearly with your age, this type of term plan provides rates that stay the very same for the duration you choose, even as you age or your health changes.

Find out a lot more regarding the Life insurance policy alternatives available to you as an AICPA member (Term Life Insurance). ___ Aon Insurance Coverage Solutions is the brand name for the brokerage and program management procedures of Fondness Insurance coverage Services, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Fondness Insurance Agency, Inc. (CA 0795465); in Alright, AIS Fondness Insurance Solutions Inc.; in CA, Aon Fondness Insurance Policy Services, Inc .

Latest Posts

Funeral Plan Broker

Funeral Cover Cost

Difference Between Life Insurance And Funeral Plan